The cost of mineral exploration continues to rise, with global spending heading towards US$14 billion this year, yet rates of mineral discovery have been on the decline since the 1980s. Is there a way to reverse the trend?

Perhaps, says Professor Bill Morris of the School of Geography and Earth Sciences at McMaster University, but only if explorers begin to integrate geoscience information in such a way that they can see through rock and overburden to find buried deposits.

“The reality is that the old days when prospectors would go out there and find a mineral deposit on the surface are gone,” he says. “We have to expand our search into deeper areas and use newer technology to enhance our search capabilities.”

That shift in exploration methodology will require training, more efficient use of exploration data, and interdisciplinary cooperation: while geophysics may be the most obvious tool for exploring the subsurface, it cannot be used in isolation.

“The new frontier is the integration of geoscience information,” says Morris. “Geophysics will take you so far, but geophysics on its own will never give you a complete answer.”

In Canada, the federal government is taking the threat of declining discovery rates seriously by committing $25 million over five years to find new base metal reserves in established mining communities. One of the main components of the Geological Survey of Canada’s Targeted Geoscience Initiative (TGI), now in its third phase, is the integration of industry and government data collected over the years to conjure up new images of old camps with the hope of discovering previously undetected ore.

The TGI also aims to produce new geological, geophysical maps and geochemical maps of the target areas, create three-dimensional representations of areas with the highest base metal potential, and come up with new and improved methods to map hidden and deep-seated base metal deposits.

In the Flin Flon mining camp of northern Manitoba, for instance, the TGI completed a 2-D high-resolution seismic survey to help identify buried VMS deposits after the GSC’s geological mapping in the area suggested a different structural model for the mining camp that was best tested by seismic tools. The Flin Flon deposits have high acoustic impedance relative to typical host rocks because of their mineral make-up (pyrite, pyrrhotite, sphalerite, and chalcopyrite).

“Before we turned up, the exploration techniques were pretty standard,” says Simon Hammer, TGI’s program manager in Ottawa, who explains that seismic has not been traditionally been used in mineral exploration, especially in relatively urban areas such as Flin Flon that have background noise. “The fact that the major stakeholder in the area then decided to follow up with 3D seismic clearly indicates that we were able to influence their exploration strategy.”

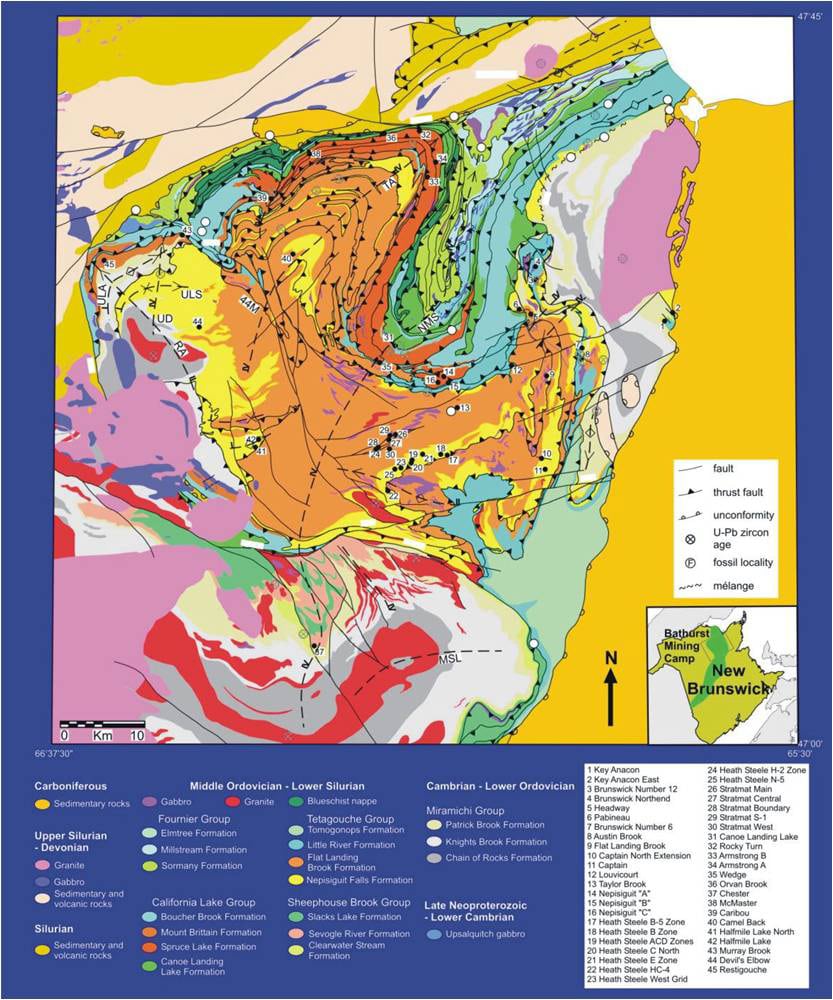

Another TGI target area, and one of the focuses of Morris’s research, is the Bathurst lead-zinc mining region in New Brunswick, an old camp that desperately needs new life. The area’s main mine, Brunswick, is expected to close by 2010 and maybe even earlier given current metal prices, sucking about $100 million per year out of the local economy and putting 800 people out of work. Junior Blue Note Mining is also preparing to shut down the Caribou and Restigouche lead-zinc mines after less than a year of commercial production.

The VMS deposits of the Bathurst camp lie in an ancient back-arc basin broken and twisted by multi-generational folding, faulting, and thrusting of several geological blocks and slivers. But the complex geology is difficult to map because most of the surface is covered by vegetation and glacial overburden, says Hernan Ugalde, a research scientist at McMaster working closely with Morris in partnership with TGI.

That’s where geophysical surveys integrated with geochemical and drilling data will play a crucial role in assessing the near-surface and subsurface geology and potentially pinpointing new mineralization.

To that end, Hernan is running detailed gravity surveys (100-200 m spacing) over three VMS deposits in Bathurst – Chester, Caribou and Armstrong B – to test a theory that there is a correlation between the vertical gravity gradient and the presence of mineral deposits in the Bathurst camp.

The push from government and academia is a good first step, but the private sector must also get smarter and more efficient about how it deals with exploration data in order to make new discoveries, the McMaster researchers say. Junior companies in particular are missing the opportunity – for lack of knowledge and/or manpower – to use technology in their favour.

“Junior exploration companies, and even some senior companies, will often chase a geophysical anomaly,” says Ugalde. “They may have very detailed geophysical information, but instead of going the extra mile to analyze the data and do some modeling to see, for example, what the actual plunge of the orebody is, they just drill it. But if you don’t know the angle of your orebody, you can miss it.”

Ugalde and Morris urge companies to slow down and hire the expertise required to analyze their data properly, especially in this era of non-stop data generation.

“It’s the difference between brute force and finesse in exploration,” says Morris. “Should you put more money into boreholes, or should you be spending a little more money and time trying to formulate a model?

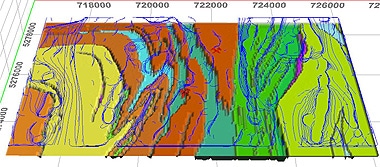

Geology and multiscale edge analysis (Worms)

Morris says the process of creating an exploration model has become much easier and more efficient with the advancement of exploration software, such as Geosoft, which provides a platform for integrating different datasets (e.g. magnetic, geochemical, topographic), bringing them all together as a single resource.

The ability to view these images in 3-D through GIS is also a crucial breakthrough, he says, because ore deposits are, by nature, three dimensional. The latest versions of Oasis montaj and Target, Geosoft’s borehole data visualization software, allow geoscientists to work seamlessly between their Geosoft and GIS (ESRI) files without leaving the Geosoft environment.

Increased access to data and the technology to process high volumes of data in meaningful ways are two main ingredients in the new search for mineral deposits. Training is the third. As part of its mandate, TGI3 is placing significant emphasis on training university students in the broad range of skills they will require to serve the mining sector, including providing them with summer jobs in the field.

Morris agrees that the industry badly needs an influx of qualified people that can make sense of data. With lots of user friendly software available, almost anyone can generate images, but only skilled personnel can separate what is meaningful in the data from what is not.

“You need direction from people with training who know how to integrate the data and understand what is behind those purple dots that you are chasing,” he says. “It is in our nature to push the data set as hard as we can, to extract as much information as we can. But you’re doing that at the expense of reality in some cases.”